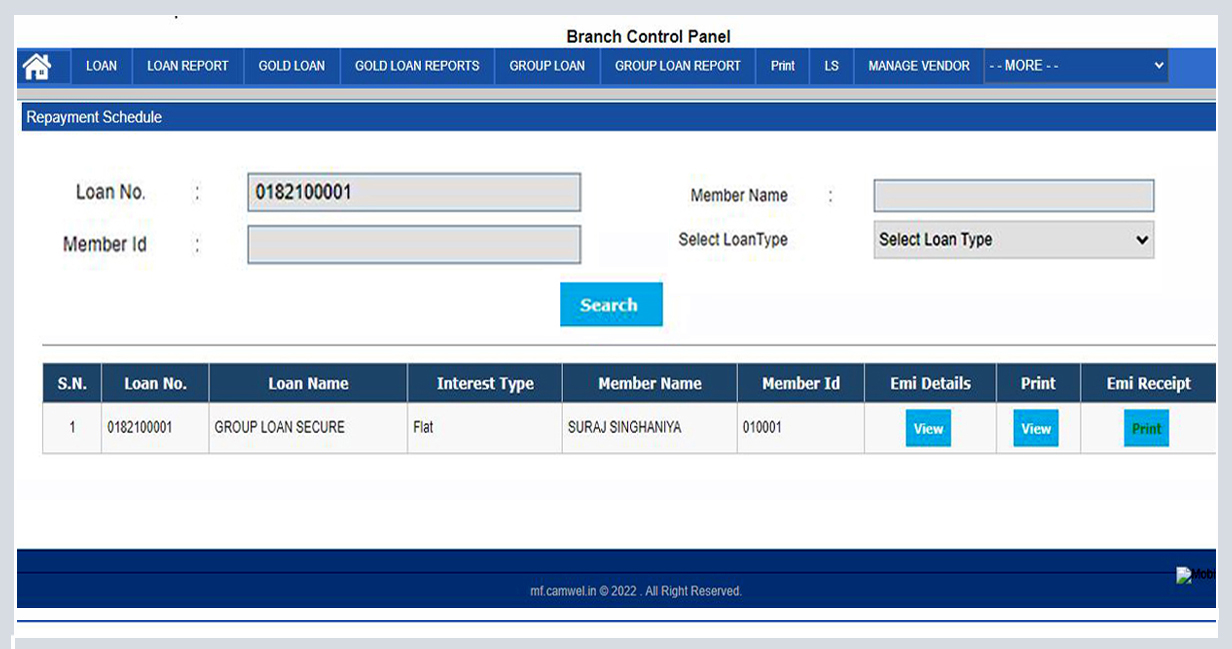

Camwel Solution is the best software provider in Patna, Pune, Bangalore, and abroad. We offer the most advanced Microfinance software solutions. Contact us today for a free demo. Our software allows you to enter more than a hundred fields of client information, and for credit products, you can add an unlimited number of products. This software offers three types of interest calculations: Flat, Declining Balance - Equal Monthly Installment (EMI), and Declining Balance - Equal Principal Installment.

We also provide all types of loans, including Banking, NBFC, Co-Operative, Billing, Personal Loan, Education Loan, Home Loan, Property Loan, Agriculture Loan, Commercial Loan, Payday Loan, Microfinance, as well as Website Design and Development. Additionally, we offer Website Design, Registration, Maintenance, and Consultation services.

Our microfinance software has been instrumental in creating a highly useful product. It has streamlined and enhanced the quality of our service, making it an excellent tool for expanding business operations.

Our company understands that business value cannot be achieved through technology alone. It starts with people—experts working together to get to the heart of your individual business objectives and develop the most tailored solutions to meet these requirements. We believe this human-centered approach to technology is what makes the difference for your business.