Microfinance Audit & Compliance

A compliance audit is a comprehensive review of an organization's adherence to regulatory guidelines. Audit reports evaluate the effectiveness and adequacy of compliance planning, security policies, user access controls, and risk management procedures.

The specific areas examined during a compliance audit vary depending on whether the organization is public or private, the nature of the data it handles, and whether it transmits or stores sensitive financial information.

Examples of compliance audits

A Sarbanes-Oxley Act compliance audit must ensure secure and backed-up electronic communication with a reliable disaster recovery system.

A Sarbanes-Oxley Act compliance audit must ensure secure and backed-up electronic communication with a reliable disaster recovery system.

Healthcare providers that store or transmit electronic health records, which may contain personal health information, are required to comply with HIPAA regulations.

Healthcare providers that store or transmit electronic health records, which may contain personal health information, are required to comply with HIPAA regulations.

Financial service companies that transmit credit card data must comply with Payment Card Industry Data Security Standards.

Financial service companies that transmit credit card data must comply with Payment Card Industry Data Security Standards.

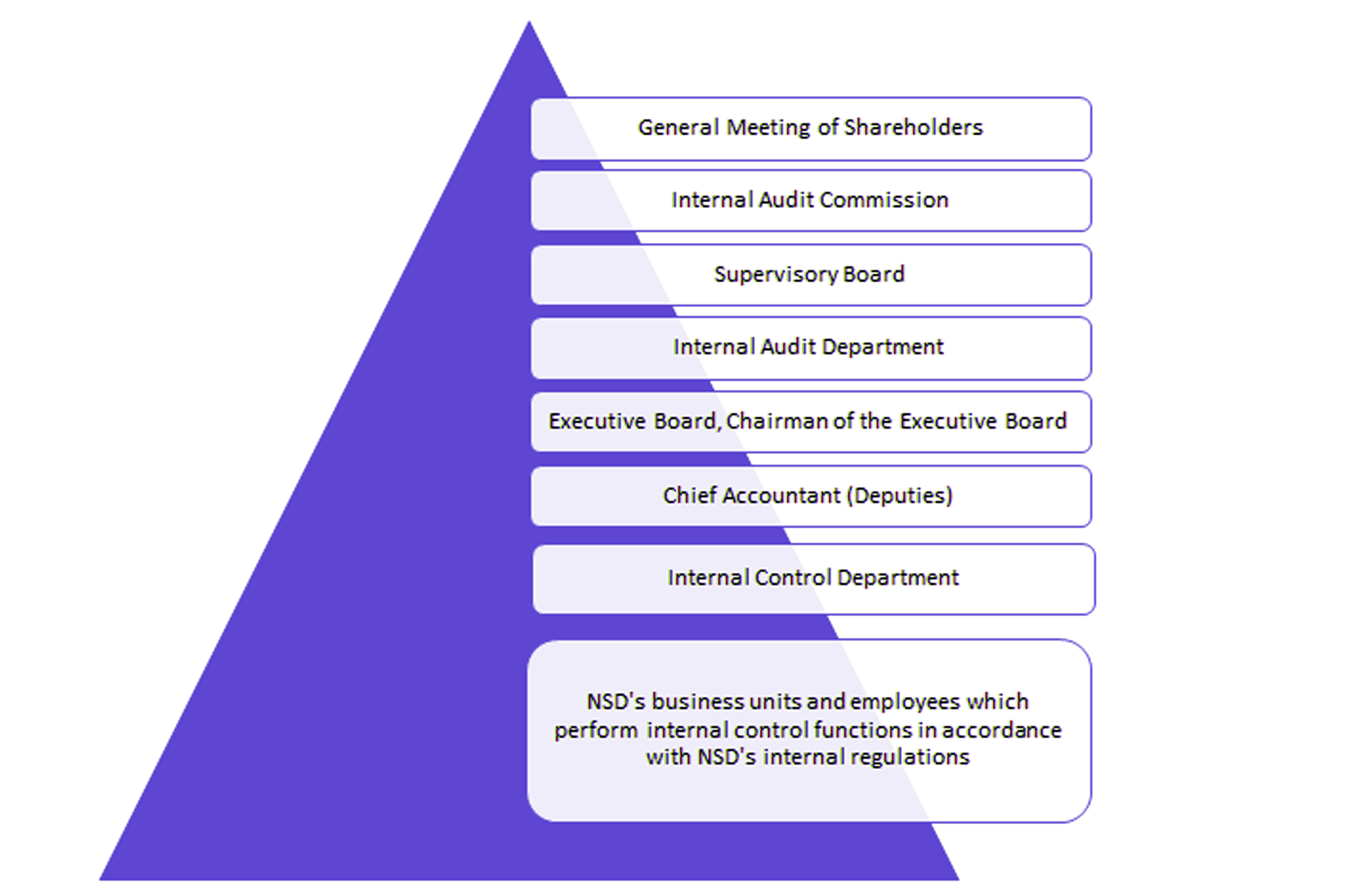

Internal audit of Microfinance Institutes (MFIs)

An internal audit is is an independent check on the performance of the MFI.

An internal audit should be an independent function that is completely separate from operations. This independence is ensured by having a dedicated staff team and the department reporting directly to the Board of Directors or the head of the organization.

It is a common belief among MFIs that having an internal audit department is enough to manage most of their risk. However, risk management and overall internal control involve a much larger scope of responsibilities, and internal audits only form a part of it.

The objective of Internal Audit is not solely to detect fraud or malpractices, but rather to enhance the value and efficiency of the organization by reducing the likelihood of malpractice.

An internal audit is is an independent check on the performance of the MFI.

An internal audit should be an independent function that is completely separate from operations. This independence is ensured by having a dedicated staff team and the department reporting directly to the Board of Directors or the head of the organization.

It is a common belief among MFIs that having an internal audit department is enough to manage most of their risk. However, risk management and overall internal control involve a much larger scope of responsibilities, and internal audits only form a part of it.

The objective of Internal Audit is not solely to detect fraud or malpractices, but rather to enhance the value and efficiency of the organization by reducing the likelihood of malpractice.

An Objective Of Internal Audit

It is important to be able to identify fraud or misappropriation, regardless of its scale or the involvement of other staff.

It is important to be able to identify fraud or misappropriation, regardless of its scale or the involvement of other staff.

To confirm if operational policies/processes are being adhered to all levels and to detect deviations

To confirm if operational policies/processes are being adhered to all levels and to detect deviations

To detect deviations and ensure adherence to operational policies and processes at all levels.

To detect deviations and ensure adherence to operational policies and processes at all levels.

To assess the perception of the organization by clients and monitor staff conduct

To assess the perception of the organization by clients and monitor staff conduct

To provide feedback or opinions related to operational risks such as staff dissatisfaction, competition, inappropriate policies, or potential conflicts.

To provide feedback or opinions related to operational risks such as staff dissatisfaction, competition, inappropriate policies, or potential conflicts.

The requirement of Internal Audit of MFIs:

It is mandatory for all MFIs to undergo internal audits. To conduct the internal audit, MFIs must appoint an internal auditor. The internal auditor should report directly to the Board of Directors and not to the Director or senior management of the MFI. This is because the findings of the audit may concern management at various levels, and reporting to the same persons would create a potential conflict of interest. Additionally, the audit report should be written in a way that protects the identity of all contributors to the findings. This is crucial in order for the auditor to be able to gather sensitive and critical information in future audits. Finally, an individual should never serve as an internal auditor for a unit(s) for which they have any direct operational or managerial responsibility.

Role Of Internal Auditor

Internal auditor's work varied from the function to function. Below are some key areas of auditing:

Assessing the management of risk:

Assessing the management of risk:

The internal auditor is responsible for evaluating an organization's risk management practices. Every organization faces a variety of risks, and it's essential to manage them effectively for success. The auditor will examine the risk management processes, internal control systems, and corporate governance procedures across the organization to ensure they are adequate.

evaluating controls and advising all level managers:

evaluating controls and advising all level managers:

An internal audit evaluates risk and reports on management policy effectiveness.

Analyzing operations and confirming information:

Analyzing operations and confirming information:

A systematic audit helps organizations achieve their objectives by effectively managing resources. Internal auditors work closely with line managers to review operations and report their findings.

Assisting the management team in enhancing their internal control mechanisms.

Assisting the management team in enhancing their internal control mechanisms.

An internal auditor should report discrepancies to management and assist in improving organizational practices.

Evaluating risks:

Evaluating risks:

Management must identify risks affecting growth and inform internal auditors to anticipate future concerns, and provide assurance, advice, and insight.

Working with other assurance providers:

Working with other assurance providers:

Internal audits don't provide any guarantee to executive management or the board’s audit committee that risks are being managed effectively. There may be other assurance providers who offer similar services.

The Scope Of Audit

Internal auditor's work varied from function to function. Below are some key areas of auditing:

Many people think that an audit only involves checking financial records and receipts. However, the scope of an internal audit is much broader than that. The objectives of this function are extensive and encompass a wide range of responsibilities. The following are some of the primary functions of an internal auditor:

Financial reports and records

Financial reports and records

It is important to carefully examine all receipts, vouchers, ledgers, cashbooks, client passbooks, bank passbooks of MFIs, and cash balances. Please check for any spelling, grammar, and punctuation errors as well.

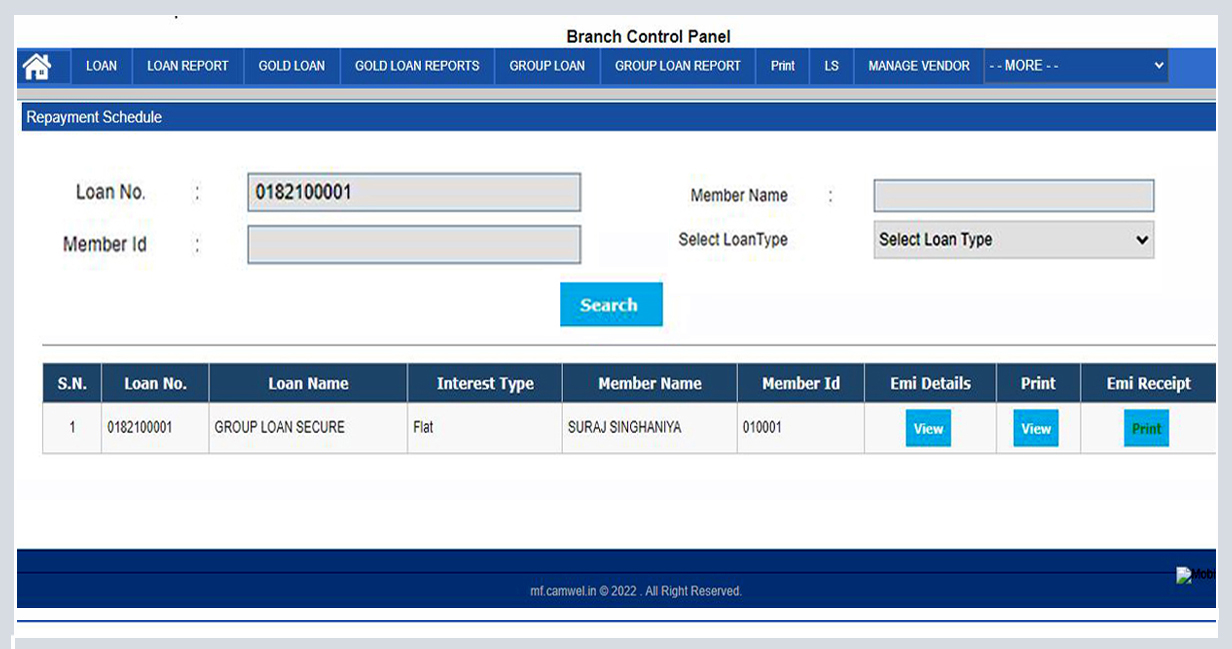

Loan documents:

Loan documents:

Loan applications, promissory notes, and related data are entered into Excel spreadsheets or software according to policy.

Client visits:

Client visits:

Scrutinize meeting discipline including timing, conduct, staff and client behavior. Interact with clients, check passbooks, and verify loan utilization.

Other observation:

Other observation:

The Internal audit covers a wide range of reports to cross-check for policy deviations or potential risks to the organization.

Conclusion:

An internal audit is a critical function that helps manage risk and provides vital feedback to top management in MFIs.